- Free microsoft office for students community college install#

- Free microsoft office for students community college professional#

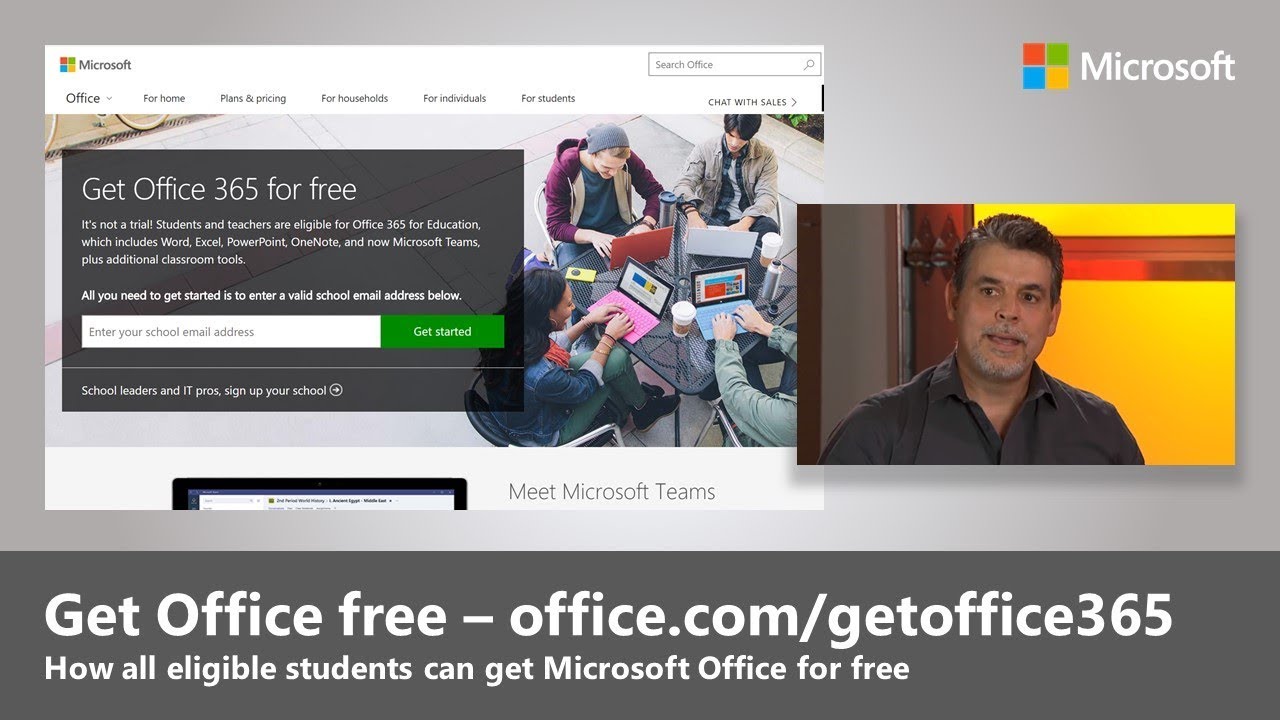

Please note: Your use of Microsoft’s 365 suite of apps and services is supported directly by Microsoft, not by the college.

Free microsoft office for students community college install#

If you do not submit this request, you will only be able to access the online versions of the Office 365 apps and will not be able to download and install them on your personal computer. Submit your RCBC activation request via this form to validate eligibility for your Office 365 license.

Once you’ve created your account, return to this page to proceed to step two.

Free microsoft office for students community college professional#

This can include community organizations, professional associations, or local businesses that offer scholarships or grants. Straham also recommends exploring all potential resources and networks available to you. "Take the time to carefully read the requirements for each scholarship and tailor your application to highlight your strengths and achievements." "Look for both national and local scholarships, as the latter may have fewer applicants and increase your chances of success," said Straham. Instead, your goal should be casting a wide net and applying to as many scholarships as possible. Milton Straham III of Straham Consulting adds you shouldn't limit yourself to just a few applications when securing scholarships. You might even learn about scholarships that haven't been tapped out yet by calling your school's financial aid office and inquiring. "Alternatively, there may be scholarship options locally, so check with community organizations such as religious institutions and local businesses," she said. Look For Scholarships And Other FundingĬhanin also suggests searching for last-minute scholarships that may be available, which you can do with search engines like Fastweb and. Private student loans are also offered without any of the money-saving payment plans and forgiveness programs you can get with federal student loans, including income-driven repayment plans and Public Service Loan Forgiveness (PSLF). However, it's worth noting that student loans from private companies often require a co-signer (unlike federal student loans), and they can cost considerably more than federal student loans over the long run.Īlso be aware that private student loans are offered without the same government protections as federal student loans, including the ability to qualify for deferment or forbearance. While many private student loan providers are offering funding these days, some of the most popular companies to check out include College Ave Student Loans, Earnest and SoFi. If getting federal student loans lined up seems like a struggle, Chanin points out that private student loans do not have any sort of deadline. "Financial aid offices and admissions reps may also help you find other funding sources to make up gaps in the cost of attendance," said Jones.

0 kommentar(er)

0 kommentar(er)